Converse Auto Title Loans provide quick cash access for vehicle owners using car equity as collateral. Interest rates vary based on vehicle value, creditworthiness, and market conditions, with higher equity potentially leading to lower rates. Repayment terms are flexible, but prompt repayment can improve future loan conditions. The interest payment is determined by vehicle valuation and loan term, with longer terms accruing more interest. These loans offer support for unexpected expenses but require responsible financial management to avoid high-interest charges.

Discovering the ins and outs of Converse auto title loans can empower you to make informed financial decisions. This article breaks down the process, starting with understanding the fundamentals of these secured loans. We’ll then delve into how interest is calculated, exploring key factors like loan terms and market rates. By understanding these dynamics, borrowers can navigate the process confidently, ensuring they secure the best possible terms for their Converse auto title loan needs.

- Understanding Converse Auto Title Loan Basics

- Calculating Interest Rate for These Loans

- Factors Influencing Your Interest Payment

Understanding Converse Auto Title Loan Basics

Converse Auto Title Loans offer a unique financing option for individuals who own their vehicles outright. This type of loan allows borrowers to use the equity in their cars as collateral, providing quick access to cash. The process involves a simple three-step procedure: applying, providing vehicle documentation, and undergoing a brief vehicle inspection. During this inspection, an appraiser assesses the car’s condition and value, ensuring it meets the lender’s standards. Once approved, borrowers can receive funds within a short timeframe, making Converse Auto Title Loans an attractive choice for those needing immediate financial support.

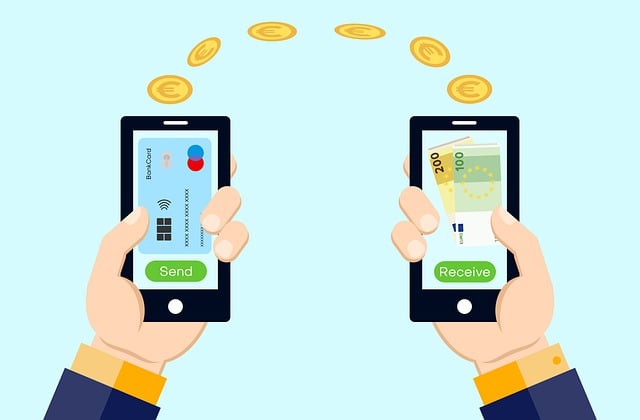

These loans are particularly beneficial for individuals who may not qualify for traditional bank loans or credit lines. With flexible repayment terms and interest rates, this alternative financing method caters to various borrower needs. Whether it’s for unexpected expenses, home improvements, or any other purpose, Converse Auto Title Loans provide a convenient solution, ensuring that vehicle owners have access to the equity they’ve built up over time.

Calculating Interest Rate for These Loans

The interest rate on a Converse auto title loan is calculated based on several factors, primarily focusing on the lender’s assessment of risk and the value of your vehicle. These loans are secured by the equity in your vehicle, so lenders determine the interest rate according to the current market value of your car, as well as your creditworthiness. The interest rate can vary between lenders and may also depend on the type of loan offered, whether it’s a short-term or long-term option.

Understanding how these rates are set is crucial for borrowers. Lenders consider factors like your credit score, income, outstanding debt, and the condition of your vehicle to decide on the interest rate. A higher vehicle equity often translates to a lower interest rate since the lender has more assurance of repayment. Additionally, prompt repayment can impact future loan approvals, as lenders may offer better rates for borrowers with a strong repayment history. Remember that while these loans provide quick access to cash, managing your finances responsibly is essential to avoid high-interest charges.

Factors Influencing Your Interest Payment

Several factors play a significant role in determining your interest payment on a Converse auto title loan. One of the primary considerations is the current market value of your vehicle, commonly referred to as the Vehicle Valuation. Lenders will assess your car’s condition, age, and overall worth to set an appropriate interest rate. The higher the vehicle valuation, the better for you, as it may result in a lower interest charge.

Additionally, the term or length of your loan influences the interest you’ll pay. Longer repayment periods typically lead to higher interest payments over time, while shorter terms can keep these costs down. Lenders in Fort Worth Loans often offer various Payment Plans tailored to borrowers’ preferences and budgets, allowing them to choose the one that suits their financial capabilities best.

Converse auto title loans offer a convenient way to access funds using your vehicle’s equity, but understanding the interest calculation is key. By grasping the factors influencing interest rates and payments, borrowers can make informed decisions. Armed with this knowledge, you’re better equipped to navigate the process, ensuring the best possible terms for your Converse auto title loan.